Frequently Asked Questions

On this page are some commonly asked questions about the company.

On this page are some commonly asked questions about the company.

1. How do I get to know more about the company’s latest earnings and future plans?

Our latest earnings and future plans may be viewed through our briefing materials, press releases and SEC reports. We also conduct regular analysts’ briefings for our investment practitioners and current stockholders. Upcoming schedules are announced via PSE Edge and in our disclosures.

2. Does the Company have a dividend policy?

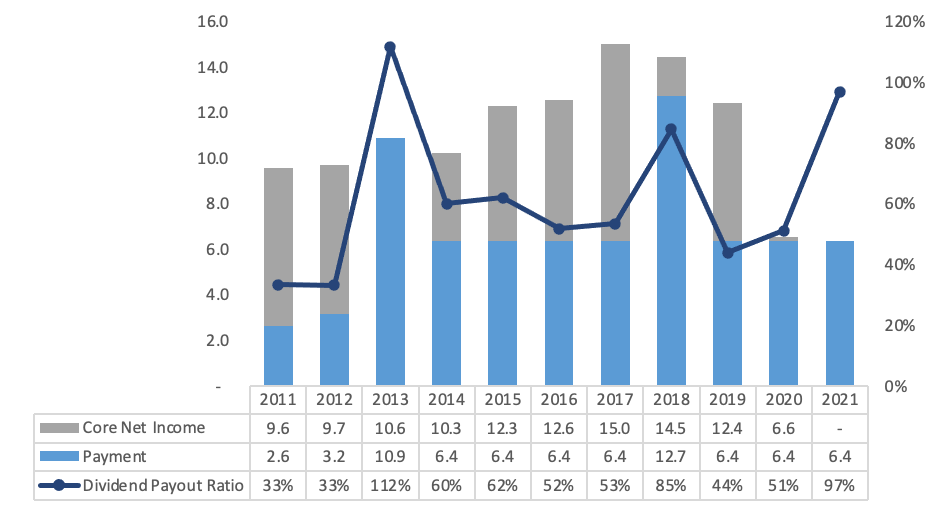

Yes. DMCI Holdings, Inc. is committed to a dividend payout ratio of at least 25% of the preceding year’s consolidated core net income. Consolidated core net income is currently defined as reported net income excluding all foreign exchange, mark-to-market gains and losses and non-recurring items. To know more about our dividend policy, click here.

3. What is the Company’s dividend track record?

In the last 10 years, DMC has consistently exceeded its dividend payout policy, with its average payout ratio reaching 69%.

4. When are dividends declared?

Regular dividends are usually declared sometime between March and June. There is no definite declaration schedule for special dividends. To know more about our historical dividends, please click here.

5. How can I know more about DMCI group subsidiaries and associate?

You may visit their respective official websites, namely:

Construction | |

Real Estate Development | |

Coal Mining and On-grid power | |

Off-grid power | |

Water services |

1. What is the Company’s accounting period?

The Company follows the calendar accounting period, which starts on January 1 and ends on December 31.

2. Who is the Company’s external auditor?

Our external auditor is SGV & Co.

3. In what currency does the financial results denominated in?

Our financial results are denominated in Philippine Peso (Php) since all subsidiaries operate in the Philippines. No currency translation is performed.

4. Where can I find DMC’s latest financial results?

5. When and how do you announce quarterly results?

Quarterly results are normally announced every May (Q1), August (Q2), November (Q3) and March (Q4/FY) through SEC filings and PSE disclosures. A few days after the disclosures, the company conducts analysts’ briefings, the details of which are announced through the PSE Edge.

3F DACON BUILDING, 2281 CHINO ROCES AVENUE

MAKATI CITY, 1231 PHILIPPINES

TEL: +(632) 8-888-3000